Shopping for a credit card can feel like stepping into a maze of options, each offering unique bonuses and rewards. But amidst the glittering offers, one crucial aspect stands out, the interest rate. Let's delve into the world of credit card interest rates and uncover how to find the best deals that can lead you to financial freedom.

What is a good APR for a credit card?

According to Experian, a major credit reporting agency, the average credit card balance per consumer stood at $5,910 in 2022. For many, this debt hangs heavy, driving the quest for a card with better-than-average interest rates. Securing such a card can pave the way for substantial savings and faster debt repayment.

Understanding APR

At the heart of credit card interest rates lies the Annual Percentage Rate (APR) – a standardized measure representing the total cost of borrowing over one year. It encompasses not only interest but also any applicable fees.

APR: Then and Now

In recent years, credit card APRs have seen a significant uptick. In 2021, the average APR for all cards hovered around 14.60%. However, by August 2023, this figure had surged to a staggering 21.19%.

Why It Matters

To grasp the impact of APR, consider this scenario: You're facing a $5,000 credit card debt. With a minimum payment requirement of 2.5% of the balance, your monthly due amounts to $125. At 14.60% APR, it would take you 55 months to clear the debt, with a total repayment of $6,774.42. However, if faced with the higher APR of 21.19%, your monthly payment increases to $138, extending your debt duration to 58 months. Consequently, you'd pay a hefty $1,222.16 more in interest, totaling $7,996.58.

Finding the Best Rates

Amidst the sea of credit card offers, identifying the best rates is crucial. Currently, any card offering an APR below the national average of 21.19% qualifies as having a "good APR." This distinction can translate into substantial savings and expedited debt clearance.

In essence, navigating credit card interest rates boils down to diligence and awareness. By understanding APRs and scrutinizing offers, you can unlock opportunities to save thousands and embark on a journey towards financial stability and freedom.

Read More: Delta SkyMiles Credit Cards: What You Need to Know

Types of Credit Card APRs

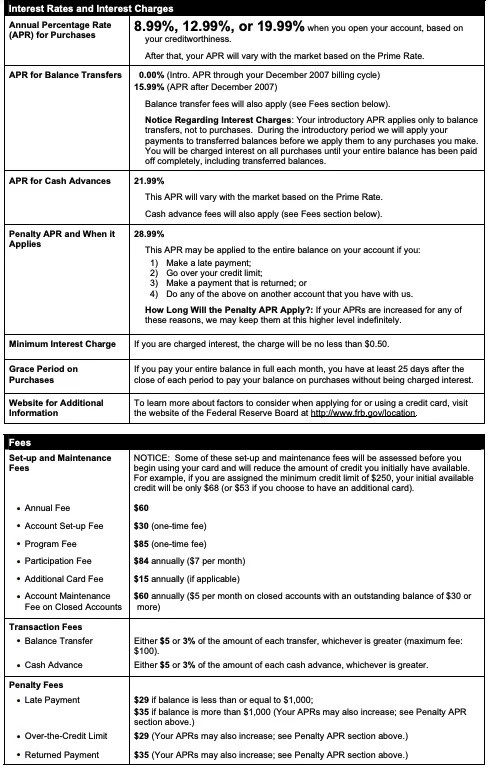

When it comes to credit cards, understanding the Annual Percentage Rate (APR) is crucial for managing your finances effectively. While most of us are familiar with the purchase APR, there are several other types of APRs you should be aware of. Let's delve into the various APRs associated with credit cards and how they can impact your financial decisions.

1. Balance Transfer APR

A balance transfer can be a savvy strategy for accelerating debt repayment and reducing interest expenses. This APR applies to balances transferred from one credit card to another, typically at a lower rate. While some issuers maintain the same APR for both purchases and balance transfers, others may offer promotional rates for balance transfers, providing a temporary reprieve from high interest.

2. Cash Advance APR

Need cash in a pinch? You can withdraw money from an ATM using your credit card, but beware: the cash advance APR is often higher than the purchase APR. Many cards impose rates upwards of 29.99% on cash advances, making it an expensive way to borrow money.

3. Penalty APR

Missed payments or insufficient funds can trigger the penalty APR, a significantly higher rate imposed by credit card issuers. This punitive measure serves as a deterrent against delinquency, but it can have dire financial consequences if activated. Penalty APRs often soar to 29.99% or higher and may remain in effect indefinitely.

4. Introductory APR Offers

For those seeking relief from high interest rates, introductory APR offers provide a temporary respite. New cardholders may enjoy a period of 0% APR on balance transfers or purchases, typically lasting between six to 18 months. Once the introductory period expires, the standard purchase APR applies, so it's essential to plan accordingly.

Comparing Credit Card Rates

Armed with knowledge about the various APRs, it's time to embark on your credit card search. When evaluating different options, pay close attention to the Schumer Box—a standardized table mandated by the CARD Act of 2010. This comprehensive disclosure outlines key terms, enabling you to compare APRs, fees, and other essential details across various credit cards.

Qualifying for the best credit card rates

To secure the best credit card interest rates, it's essential to understand the factors that influence your eligibility and how to maintain a healthy credit profile. Let's explore the steps you can take to qualify for favorable rates and optimize your financial well-being.

1. Understand Your Payment Habits

If you consistently pay your credit card statement balance in full by the due date, you won't incur any interest charges, regardless of the card's APR. This practice is vital for those who prefer to avoid interest accumulation and maximize the benefits of their credit card rewards. By staying on top of payments, you can leverage your credit card for its perks without worrying about high APRs.

2. Focus on Maintaining Good Credit

To qualify for the best credit card rates, aim for a credit score ranging from 670 to 850, indicating good to excellent credit. Building and preserving a solid credit history involves several key strategies:

● Timely Payments: Your payment history carries significant weight in determining your credit score. Consistently pay at least the minimum amount due by the statement due date for all your bills to demonstrate responsible financial behavior.

● Manage Credit Balances: Keeping your credit card balances low not only makes them easier to handle but also contributes positively to your credit score. Maintaining a low credit utilization ratio— the ratio of your credit card balances to your credit limits— signals to lenders that you manage credit responsibly.

● Strategic Credit Applications: Be judicious when applying for new credit. Each credit inquiry can temporarily lower your credit score by several points. Resist the temptation to apply for new credit impulsively and only seek additional credit when necessary and confident in your eligibility.

By adhering to these fundamental principles of credit management, you can position yourself for the best credit card rates and unlock opportunities for financial stability and growth.

Finding credit card APRs requires diligence and informed decision-making. By understanding the nuances of each APR type and carefully evaluating your options, you can choose a credit card that aligns with your financial goals and helps you save money in the long run.

In essence, achieving the best credit card rates hinges on responsible financial habits and prudent credit management. By prioritizing timely payments, maintaining low credit balances, and exercising restraint in credit applications, you can pave the way for favorable interest rates and a brighter financial future.

Editorial Disclosure: The details provided in this article have not been reviewed or endorsed by any advertiser. The information regarding financial products, such as card rates and fees, is accurate as of the publish date. All products and services are presented without warranty.

English (United States) ·

English (United States) ·