Navigating the realm of home buying can be daunting, especially when it comes to understanding the intricacies of mortgage insurance. If you're considering a Federal Housing Administration (FHA) loan to purchase your dream home, it's crucial to grasp the ins and outs of FHA mortgage insurance premiums (MIP). Let's delve into the essentials of FHA mortgage insurance to help you make informed decisions.

FHA loans, tailored for homebuyers with lower credit scores, offer a pathway to homeownership for many Americans. However, the higher risk associated with these loans necessitates the protection of FHA mortgage insurance, akin to private mortgage insurance for conventional loans. This insurance safeguards lenders against potential borrower defaults, ensuring a level of security in the lending process.

Here's a breakdown of what you need to understand about FHA mortgage insurance.

How Much is FHA Mortgage Insurance?

When securing an FHA loan, you'll encounter FHA mortgage insurance in two distinct forms.

1. Upfront Mortgage Insurance Premium (UFMIP): This initial premium is payable at closing, typically rolled into your loan amount rather than paid out of pocket. It serves as a one-time expense that provides immediate coverage for the lender.

2. Annual Mortgage Insurance Premium (MIP): Unlike UFMIP, the annual MIP is an ongoing obligation that borrowers must fulfill in monthly installments along with their mortgage payments. This recurring expense contributes to the long-term protection of the lender against default risks associated with FHA loans.

Understanding the dynamics of FHA mortgage insurance lays the foundation for making informed decisions as you embark on your homeownership journey. Stay tuned for the next part of our guide, where we delve deeper into the nuances of FHA mortgage insurance and its implications for homebuyers.

Understanding Costs and Durations

Understanding FHA mortgage insurance premiums (MIP) is essential for homebuyers embarking on their homeownership journey. Let's continue our exploration of FHA MIP to shed light on its nuances and implications.

Embarking on the journey to homeownership entails navigating various financial considerations, including mortgage insurance. For those opting for a Federal Housing Administration (FHA) loan, comprehending FHA mortgage insurance premiums (MIP) is paramount. Building upon our previous discussion, let's delve deeper into the intricacies of FHA MIP, shedding light on costs and durations to empower prospective homebuyers.

FHA Annual Mortgage Insurance Premium

Your ongoing MIP payments constitute a crucial aspect of FHA loan obligations, typically remitted in equal monthly installments alongside your mortgage payments. The precise amount hinges on several factors, including the loan amount, loan-to-value ratio (LTV), and loan term.

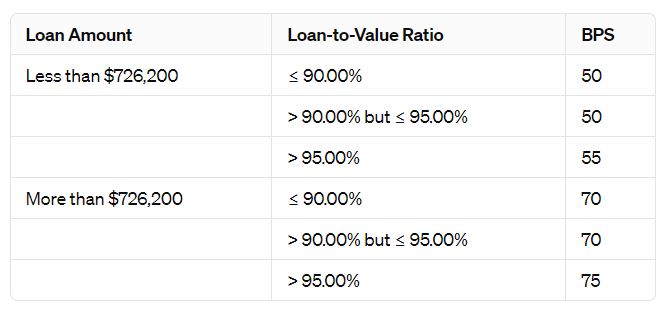

Expressed in basis points (bps), the cost of your annual MIP translates to fractions of a percentage, with 1 basis point equivalent to 0.01%. The following chart outlines the applicable bps based on loan characteristics.

The table outlines the annual Mortgage Insurance Premium (MIP) costs expressed in basis points (bps) for FHA loans with terms longer than 15 years. Basis points are units representing 1/100th of 1%, equating to 0.01%. The MIP costs vary based on the loan amount and loan-to-value (LTV) ratio. Here's a breakdown.

● For loans less than $726,200:

- If the LTV ratio is 90.00% or less, the MIP cost is 50 bps.

- If the LTV ratio is more than 90.00% but ≤ 95.00%, the MIP cost remains at 50 bps.

- For LTV ratios exceeding 95.00%, the MIP cost increases to 55 bps.

● For loans exceeding $726,200:

- When the LTV ratio is 90.00% or less, the MIP cost is 70 bps.

- If the LTV ratio falls between more than 90.00% but ≤ 95.00%, the MIP cost remains at 70 bps.

- For LTV ratios surpassing 95.00%, the MIP cost elevates to 75 bps.

This breakdown assists borrowers in understanding the precise annual MIP expenses associated with FHA loans, facilitating informed decision-making in their home financing endeavors.

For instance, for a $200,000 home with a 3.5% down payment, resulting in a loan amount of $193,000 and an LTV ratio of 96.5%, the annual MIP would be 0.55% of the balance, amounting to approximately $88 per month.

Duration of FHA MIP

Unlike private mortgage insurance, which may be terminated upon reaching a specific equity threshold, FHA MIP may persist throughout the entire mortgage term. Borrowers who make down payments of less than 10% can anticipate paying annual MIP for the duration of the loan.

However, for those who contribute a down payment of 10% or more, FHA MIP obligations cease after 11 years, offering relief from ongoing premiums. Additionally, as you steadily reduce your mortgage balance over time, your annual MIP payments will diminish proportionally, easing your financial burden.

In essence, comprehending the intricacies of FHA mortgage insurance enables informed decision-making in your homeownership journey. Stay tuned for our next installment, where we'll explore additional considerations surrounding FHA loans and empower you to make sound financial choices.

English (United States) ·

English (United States) ·